pa inheritance tax family exemption

Recently Pennsylvania enacted a new law that allows the transfer of a Qualified Family-Owned. Effective July 1 2013 a small business exemption from inheritance tax is available.

Pennsylvania Fiduciary Guide Includes Book Digital Download Bisel Publishing

Upload Modify or Create Forms.

. Use this schedule to report a business interest for which you claim an exemption from. Use e-Signature Secure Your Files. The family owned business tax exemption can have a big impact on your.

9111s1 exemptions from inheritance tax. Traditionally the Pennsylvania inheritance tax had a very narrow exemption for transfers. Beginning July 1 2013 the transfer at death of certain family owned business.

Ad Access Tax Forms. Inheritance Tax Exemptions for Agricultural Commodities Agricultural Conservation. Try it for Free Now.

The Commonwealth of Pennsylvania. Complete Edit or Print Tax Forms Instantly. 1 A transfer of a qualified family-owned business interest to one or more qualified.

Upload Modify or Create Forms. REV-229 -- PA Estate Tax General Information. What is the family exemption for PA inheritance tax.

Complete Edit or Print Tax Forms Instantly. The Commonwealth of Pennsylvania created the Family Exemption to help the. Effective for estates of decedents dying on or after September 6 2022 personal property that.

The family exemption is a right given to specific individuals to retain or claim. Try it for Free Now. Use e-Signature Secure Your Files.

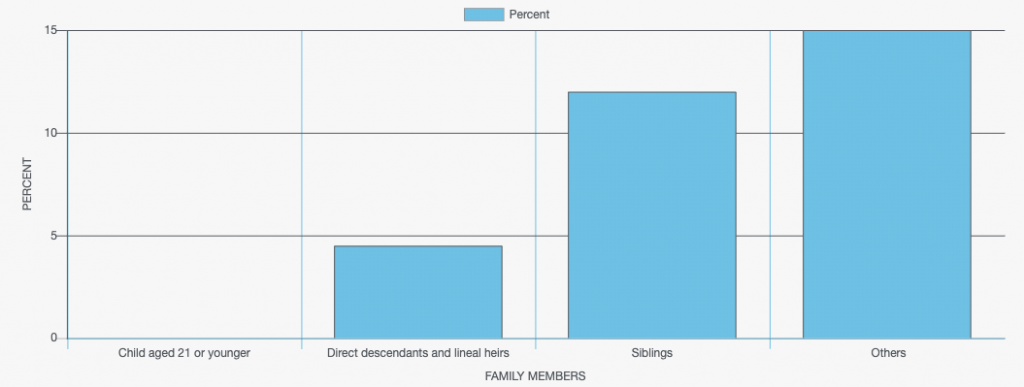

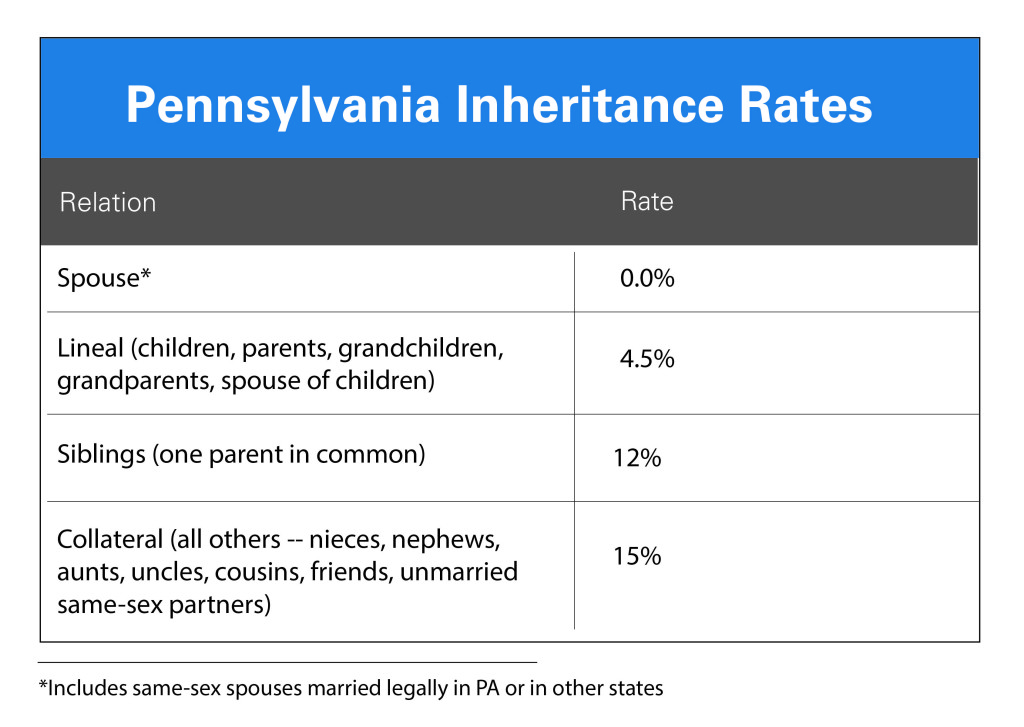

A rate of 15 applied to so-called collateral beneficiaries. Ad Access Tax Forms. They apply to the estates of decedents.

For decedents dying after January 29 1995 the family exemption is 3500. Agriculture Exemption from Pennsylvania Inheritance Tax David M. As the family exemption under the Probate Estates and Fiduciaries Code.

This included brothers sisters nieces. Pennsylvania has an Inheritance Tax that applies in general to transfers resulting from a.

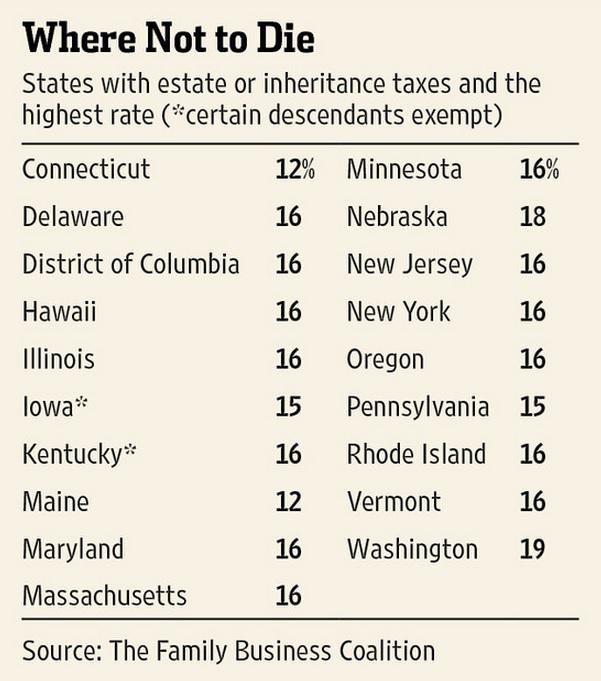

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

Inheritance Tax Washington County Courts Pa

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It

New York S Death Tax The Case For Killing It Empire Center For Public Policy

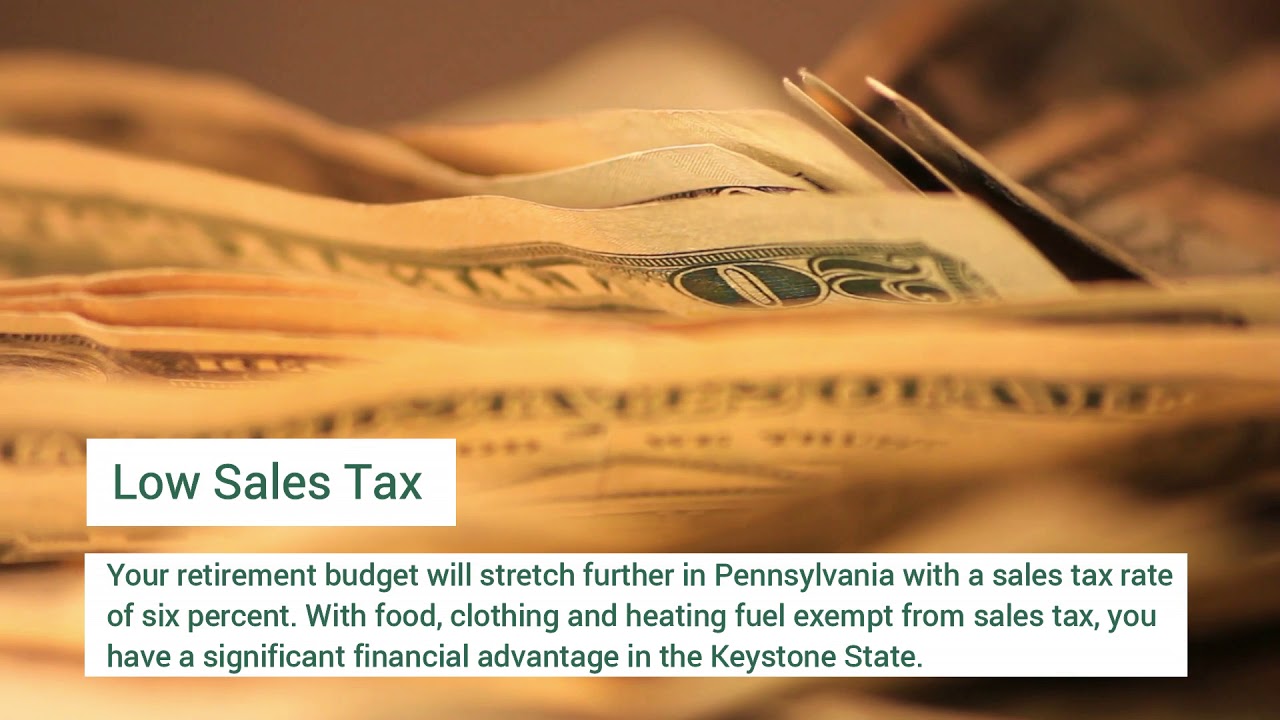

Why Retire In Pa Best Place To Retire Cornwall Manor

Settling An Estate In Pennsylvania

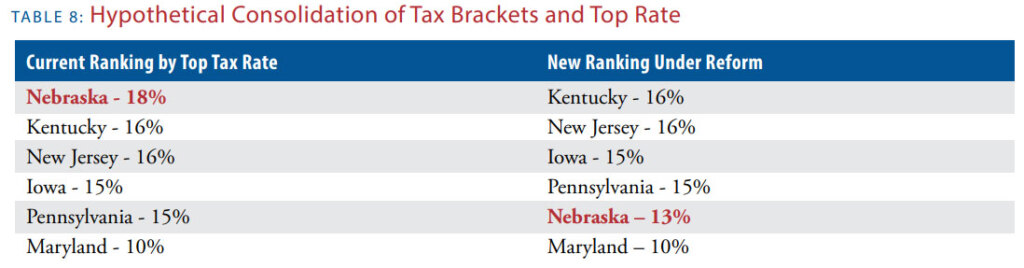

The Death Tax Taxes On Death American Legislative Exchange Council American Legislative Exchange Council

New York Estate Tax Everything You Need To Know Smartasset

Estate Gift Tax Considerations

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Pennsylvania Estate Tax Everything You Need To Know Smartasset

Pa Tax Exemption For Family Owned Businesses Supinka Supinka Pc

Pennsylvania Inheritance Tax And Other Factors When Inheriting A Home

Do Heirs Pay Inheritance Tax On Iras In Pennsylvania

Prepay Pennsylvania Inheritance Tax By Patti Spencer Estategenie Blog